does oklahoma have an estate or inheritance tax

It does allow portability between spouses. A qualified personal residence trust or QPRT can provide estate and gift tax savings but they also can be complicated to set up and maintain May 02 2022 3 min read Estate Planning.

Indiana Estate Tax Everything You Need To Know Smartasset

20 for the first 1500 of the vehicles value.

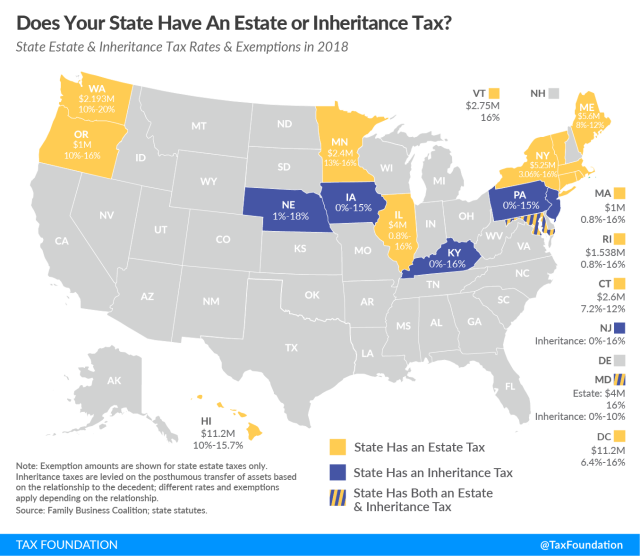

. Inheritance Taxes or Estate Taxes These may be federal or state taxes due after a death. Some taxes are paid by the. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

If your probate case does not pay then you owe us nothing. Get a list of states without an estate or inheritance tax. Alabama is one of the few states that does not exempt food from sales tax.

Impose estate taxes and six impose inheritance taxes. The state does have a gas tax along with sin taxes on cigarettes and alcohol but these are relatively low. But that changed in 2001 when federal tax law amendments eliminated the credit.

An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate. A revocable trust exists during the lifetime of the grantor and is usually managed by the grantor or someone they designate. A majority of US.

This is particularly true if you have to deal with estate taxes. Get the right guidance with an attorney by your side. You can use the advance for anything you need and we take all the risk.

The federal estate tax return offered a credit toward state-level estate taxes and states based their own tax rates on this federal credit. There is no obligation. At one point all states had an estate tax.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. If a will is not present every state or country has a law called intestacy laws that will be the basis for determining inheritance.

The tax burden that your estate has is another factor that could prolong the probate. 2010 in Kansas and Oklahoma. As a result a couple may be able to shield up to 10 million from.

325 of purchase price. It has no estate or inheritance tax. How an Estate Tax Works.

Twelve states and Washington DC. Maryland is the only state to impose both. Those tax breaks come in different formsexemptions tax credits deferrals and rate freezes.

When the first spouse passes away the second spouse must timely file a Maryland estate tax return to claim the unused portion of the 5 million estate tax exemption. However Maryland does have one important feature to its estate tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Fortunately these taxes are almost a thing of the past. Oklahoma state income tax rates range up to 5. 325 for remainder of the value.

Localities can add as much as 75 to that and the average combined rate is 922. Get a list of states without an estate or inheritance tax. And sales taxes there are no taxes in Oklahoma that will significantly affect the budgets of most seniors.

Only a handful of states still collect an inheritance tax. If the estate has real estate in multiple states you may have to go through separate probate processes which may or may not delay the distribution of assets. Learn Oklahoma tax rates for income property sales tax and more to estimate how much you will pay in 2022.

States wont collect a death tax at the state level. Obtaining a Lien Release. Those states with a tax have a relatively high threshold before taxes are due.

A revocable living trust does not have the same tax sheltering benefits as other types of trusts. Estate The term used to refer to assets left behind after the death of a person. New Jersey phased out its estate tax in 2018.

Your credit history does not matter and there are no hidden fees. Many states repealed their estate taxes as a result. Once you have paid off your car loan your Oklahoma lender has 7 days to send you a lien release.

Seniors age 65 or older with income below 12000 can claim an income tax credit for. The grantor can choose to revoke the trust and regain and retain ownership of the assets at any time. Our network attorneys have an average customer rating of 48 out of 5 stars.

The only tax thats steeper in Oklahoma than in the rest of the country is the sales tax.

Inheritance Tax Here S Who Pays And In Which States Bankrate

Do I Need To Pay Inheritance Taxes Postic Bates P C

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

State Estate And Inheritance Taxes Itep

Iowa Estate Tax Everything You Need To Know Smartasset

Death And Taxes Nebraska S Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Oklahoma Estate Tax Everything You Need To Know Smartasset

Here S Which States Collect Zero Estate Or Inheritance Taxes

Calculating Inheritance Tax Laws Com

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Need To Pay Inheritance Taxes Postic Bates P C

Is There A Federal Inheritance Tax Legalzoom Com

Oklahoma Estate Tax Everything You Need To Know Smartasset