texas auto sales tax

A motor vehicle sale includes installment and credit sales and exchanges for property services or money. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Some dealerships may charge a documentary fee of 125 dollars.

. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. The county the vehicle is registered in. Motor Vehicle Gross Rental Receipts Tax.

If you are a Texas resident and have not previously paid a Texas sales tax on the vehicle you will pay either a 625 sales tax or the difference between the full amount of taxes less any. Texas collects a 625 state sales tax rate on the purchase of all vehicles. Local tax rates range from 0 to 2.

This amount does not include sales. Motor Vehicle Local Sports and Community Venue District Tax for Short-Term Rentals. There is no tax due when a purchaser trades in a motor vehicle of greater value on a motor vehicle of lesser value commonly referred to as a trade-down.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive. The use tax rate. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle.

Motor Vehicle Taxes and Surcharges. Both new and established Texas residents are required by the Texas Comptroller to pay a use tax that is imposed on the total of the sales tax for the vehicle transaction. If you purchased the car in a private sale you may be taxed on the.

In addition to taxes car purchases in Texas. All residence homestead owners are allowed a 25000 homestead exemption from their homes value for school district taxes. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

Texas has a 625 statewide sales tax rate but also has 989 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 169 on. There is a 625 sales tax on the sale of vehicles in Texas. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state.

If a county collects a. However there may be an extra local or county sales tax added onto the base 625 state tax. Higher Than Normal Call Volume.

Include the cost of the vehicle additional options and destination charges. You can count on Texas Auto for an opulent service experience from the moment you enter our showroom. Visit us today at our South location 16200 Hwy 3 Webster TX 77598 or our.

AP-169 Texas Application for Motor Vehicle Seller-Financed Sales Tax Permit PDF 14-117 Texas Motor Vehicle Seller. Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. Total purchase price before tax This is the total cost of your auto purchase.

For example Sally purchases. Forms for Motor Vehicle Seller-Financed Sales Tax.

Free Texas Dmv Bill Of Sale Form For Motor Vehicle Trailer Or Boat Pdf

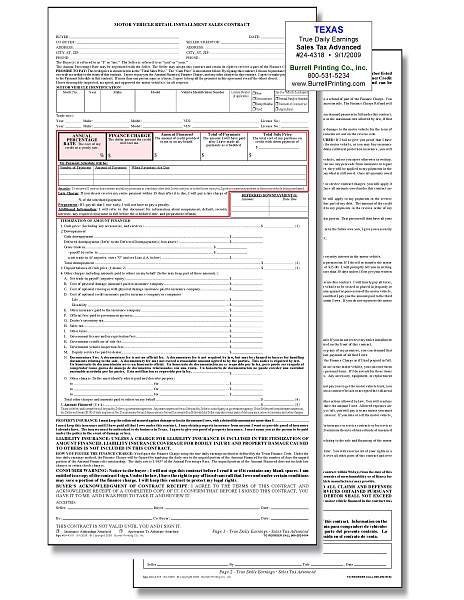

Burrell Printing Company Inc Our Products Auto Dealers Installment Contracts Texas Motor Vehicle Installment Contract 24 4318

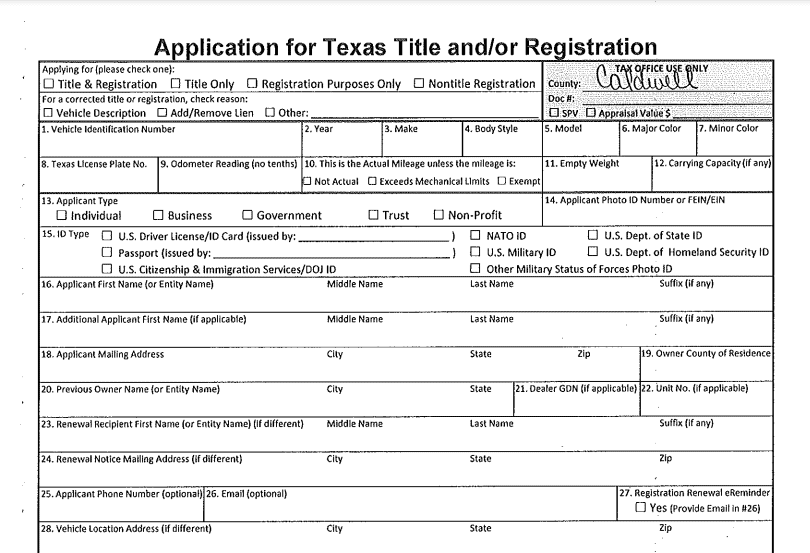

How Much Is Tax Title And License In Texas The Freeman Online

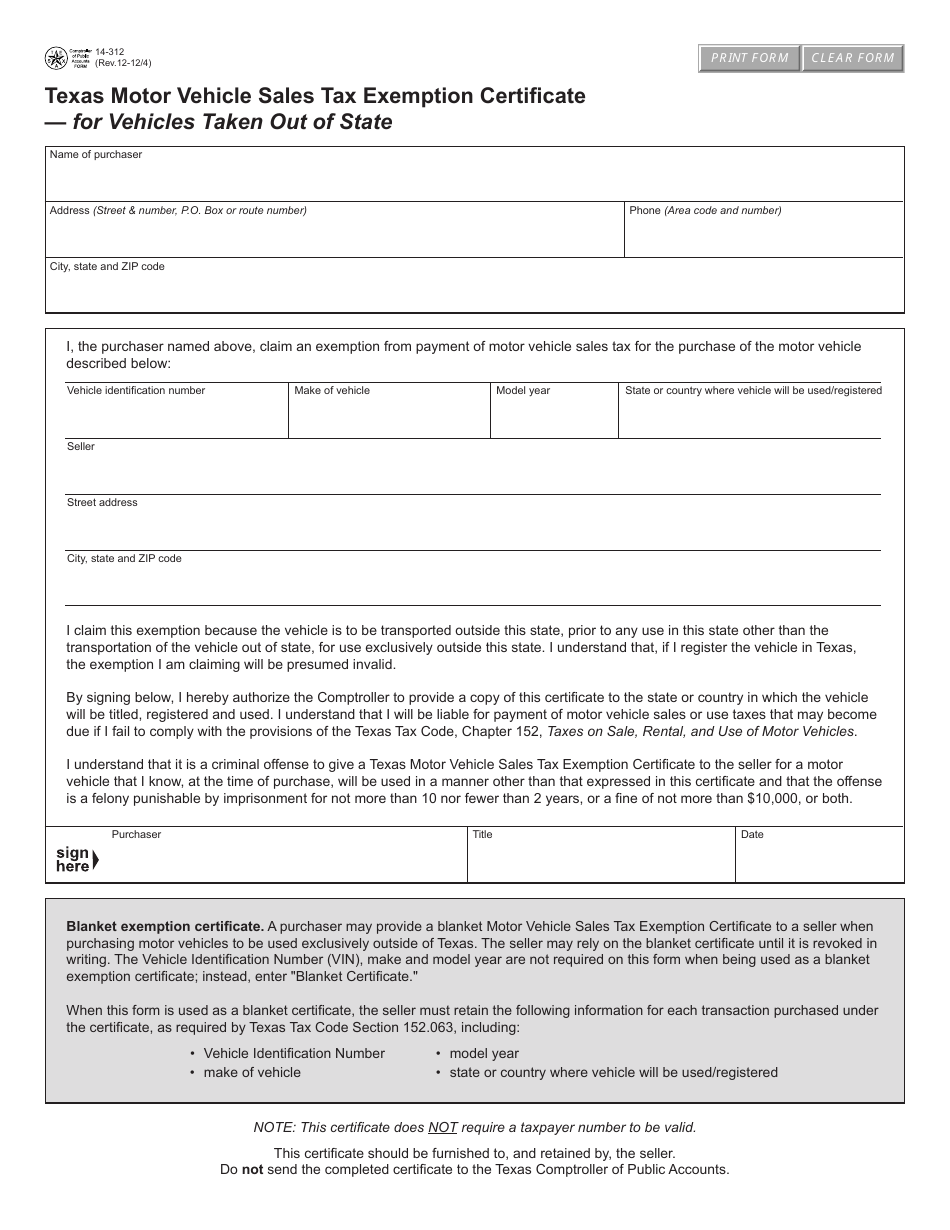

Form 14 312 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State Texas Templateroller

Texas Sales Tax Holiday Is Aug 5 7 News Corsicanadailysun Com

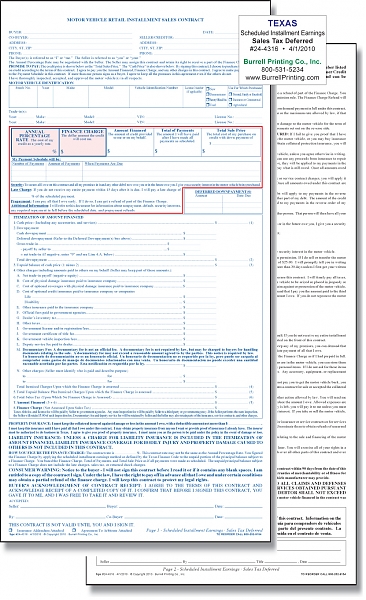

Burrell Printing Company Inc Our Products Auto Dealers Installment Contracts Texas Motor Vehicle Installment Contract 24 4316

Form 14 312 Fillable Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State

Vehicle Title Tax Insurance Registration Costs By State For 2021

Form 14 202 Fillable Texas Claim For Refund Of Motor Vehicle Tax

Texas Comptroller Provides Sales And Use Tax Relief In Response To Covid 19 Graves Dougherty Hearon Moody

Texas Vehicle Registrations Titles And Licenses

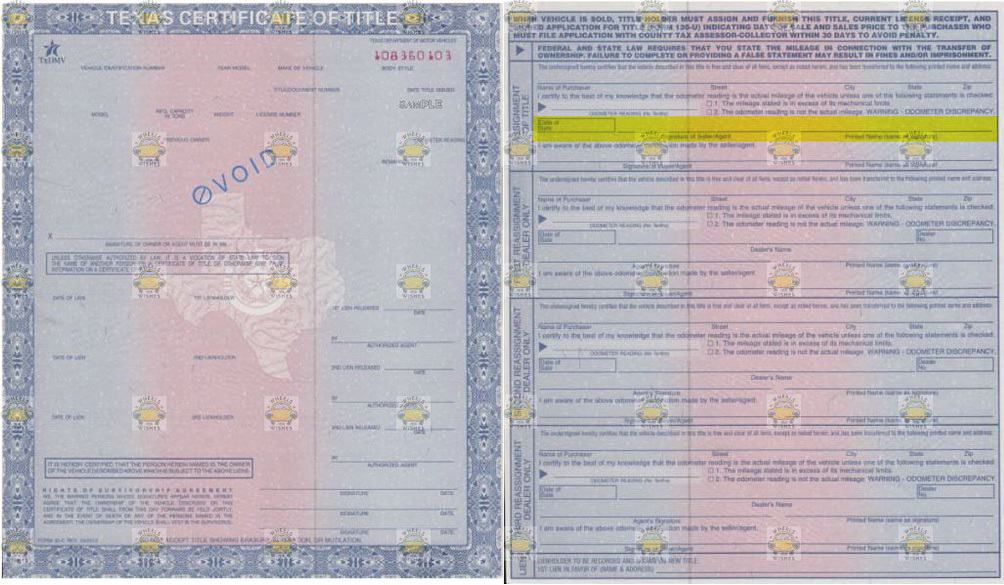

Title Questions For Vehicle Donation In Texas

Texas Auto Sales Videos Facebook

Free Texas Car Bill Of Sale Template Fillable Forms

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

How To Transfer My Texas Title Here S How With Examples

What To Know About Shopping Tax Free In Texas This Weekend