will long term capital gains tax change in 2021

This new rate will be effective for sales that occur on or after Sept. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

At worst the IRS will take a 20 piece.

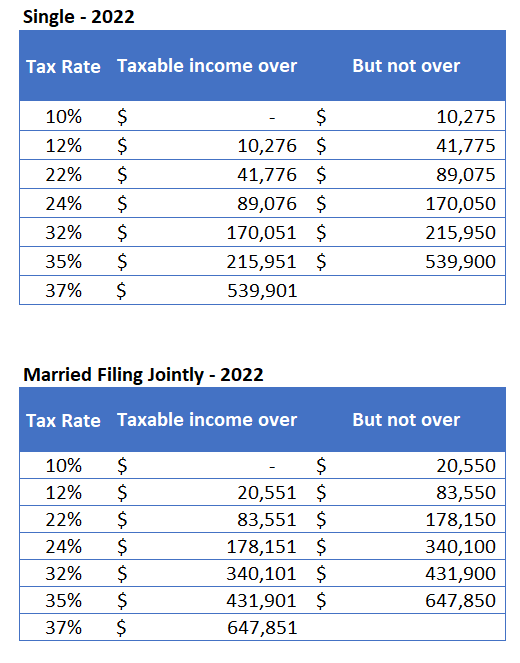

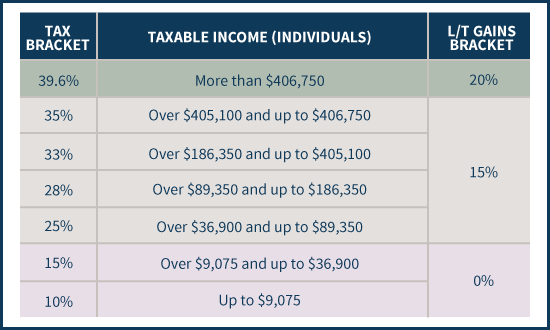

. Under this proposal the 396 capital gains rate would apply to long-term and short-term gains as well as dividends. Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. Currently long-term capital gains are in general.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. Under the current rules long-term capital gains are taxed at 20 per cent. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

It also includes income thresholds for Bidens top rate proposal and. However it was struck down in March 2022. Weve got all the 2021 and 2022 capital gains.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. The maximum capital gains are taxed would also increase from 20 to 25. 13 2021 and will also apply to.

In the case of all other assets a 20 tax with indexation on gains on sale post holding a period of 36 months was proposed. Here are the 2021 long-term capital gains tax rates. In the case of equity if the gain is more than Rs 1 lakh a 10 per cent tax is levied.

The current capital gain tax rate for wealthy investors is 20. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. From 1998 through 2017 tax law keyed the tax rate for long-term capital gains to the taxpayers tax bracket for ordinary income and set forth a lower rate for the capital gains.

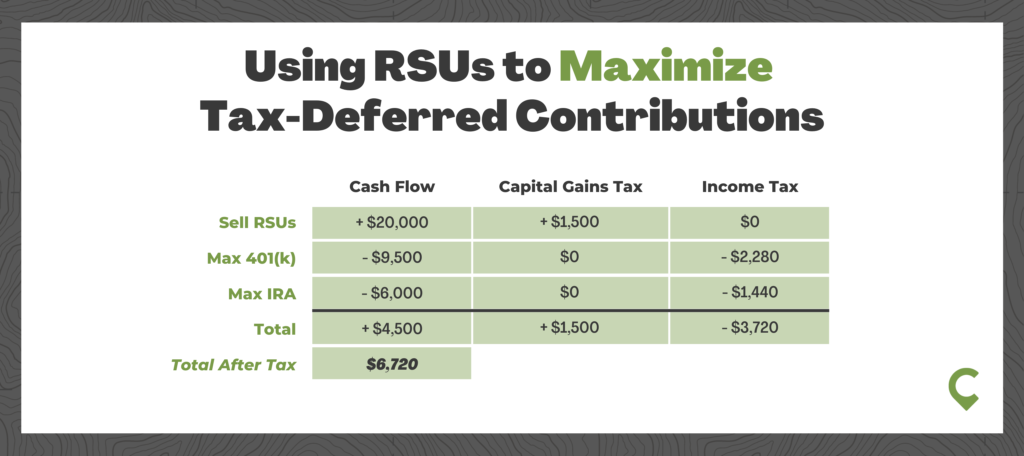

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. The table below breaks down how much you will have to pay in long-term capital gains for tax year 2022 which you will file in early 2023 based on your tax-filing status and income. In Canada 50 of the value of any capital gains is taxable.

For taxpayers over the 1M income threshold this. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

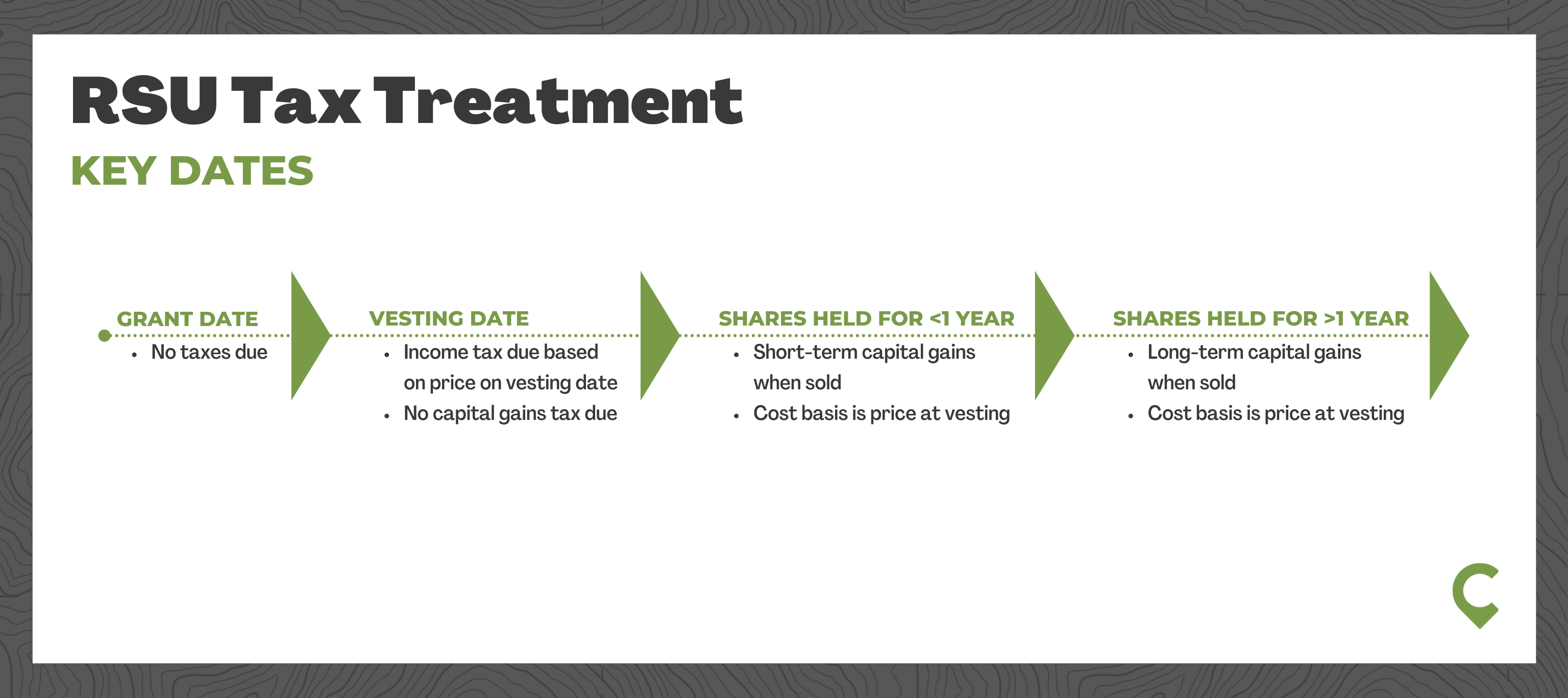

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. As a reminder the proposal calls for taxing long-term capital gains at ordinary income rates for high-income individuals and trusts 408 being the highest capital gains rate. However a 15 per.

If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans. As per the report the panel proposed a long-term capital gains LTCG tax of 10 per cent on profits from the sale of equity assets that are held for more than a year.

Specifically the current top capital gains rate is 238 20 plus a 38. As the tables above show many taxpayers are eligible to have their long-term capital gains taxed at 0 or 15. By contrast with short.

The sale price minus your ACB is the capital gain that youll need to pay tax on. In our example you would have to include 1325.

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates By State

Rsu Taxes Explained 4 Tax Strategies For 2022

2020 2021 Capital Gains And Dividend Tax Rates Wsj

Rsu Taxes Explained 4 Tax Strategies For 2022

What Are Capital Gains Taxes And How Could They Be Reformed

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

September 13 2021 Update Democrats Propose New Tax Increases Srs

How The Potential Tax Changes Can Impact Your Investments Chase Com

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Mechanics Of The 0 Long Term Capital Gains Rate

President Biden S Capital Gains Tax Plan Forbes Advisor

12 Ways To Beat Capital Gains Tax In The Age Of Trump